Homeowners Insurance in and around Odenton

If walls could talk, Odenton, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

Your home is a special place. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, the leading provider of homeowners insurance. State Farm Agent Paul Counts is your dependable authority who can offer coverage options personalized for your specific needs.

If walls could talk, Odenton, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Why Homeowners In Odenton Choose State Farm

From your home to your favorite hobbies, State Farm has insurance coverage that will keep your valuables secure. Paul Counts would love to help you know what insurance fits your needs.

It's always the right move to get State Farm's homeowners insurance. Then, you won't have to worry about the unanticipated ice storm damage to your property. Contact Paul Counts today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

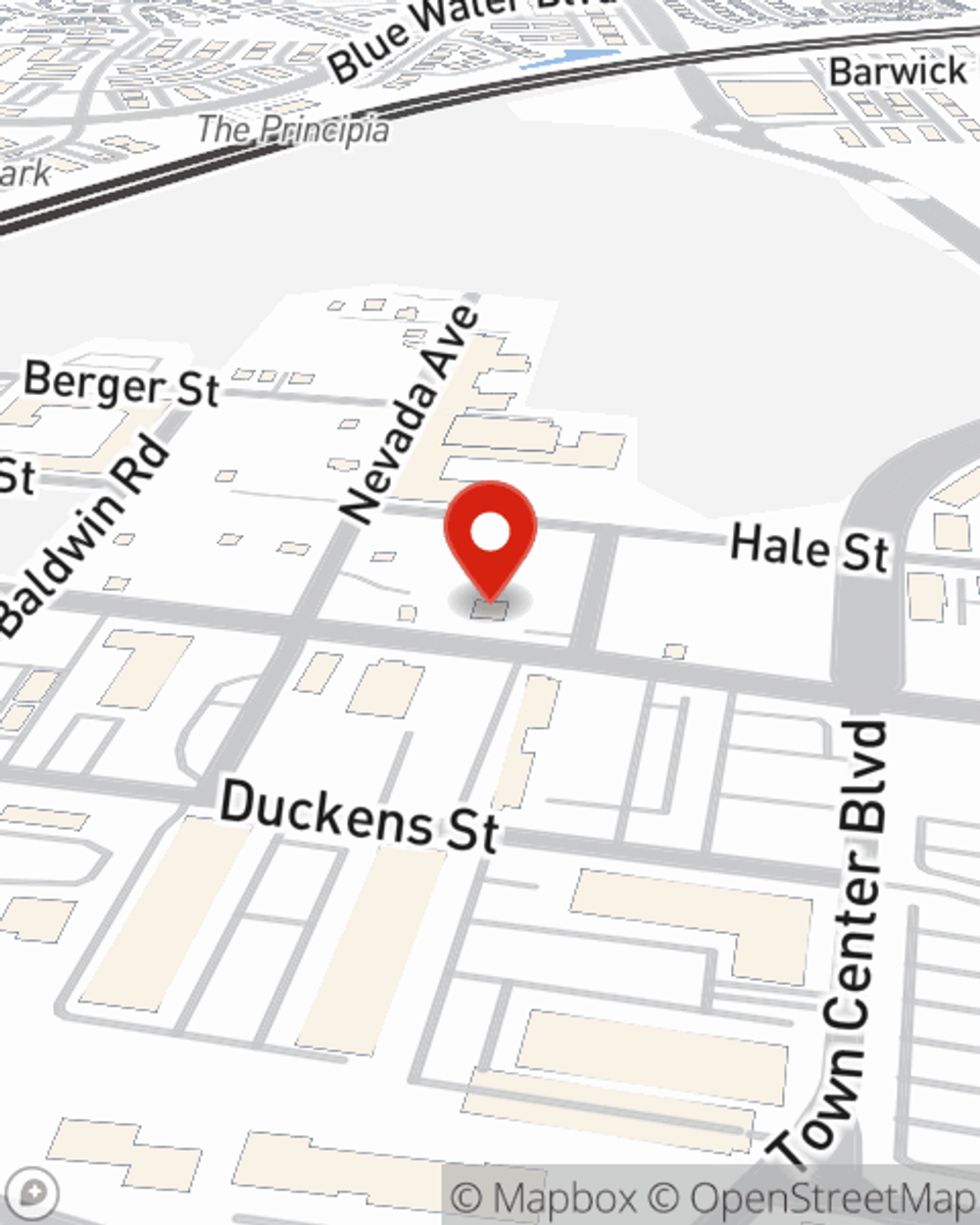

Call Paul at (301) 474-0300 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Paul Counts

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.